Solution - Single-Stock Factor Pricing#

1. Test on S&P 500 Stocks#

Data#

Use SAMPLING of weekly.

../data/spx_returns_{SAMPLING}.xlsx../data/factor_pricing_data_{SAMPLING}.xlsx

1.2.#

Consider the following factor models:

CAPM: MKT

Fama-French 3F: MKT, SMB, HML

4-Factor: MKT, HML, RMW, UMD

Calculate the factor pricing model using the single-name stocks as the test assets.

For each pricing model, report the the annualized mean of the absolute (value of the) alphas.

1.2.#

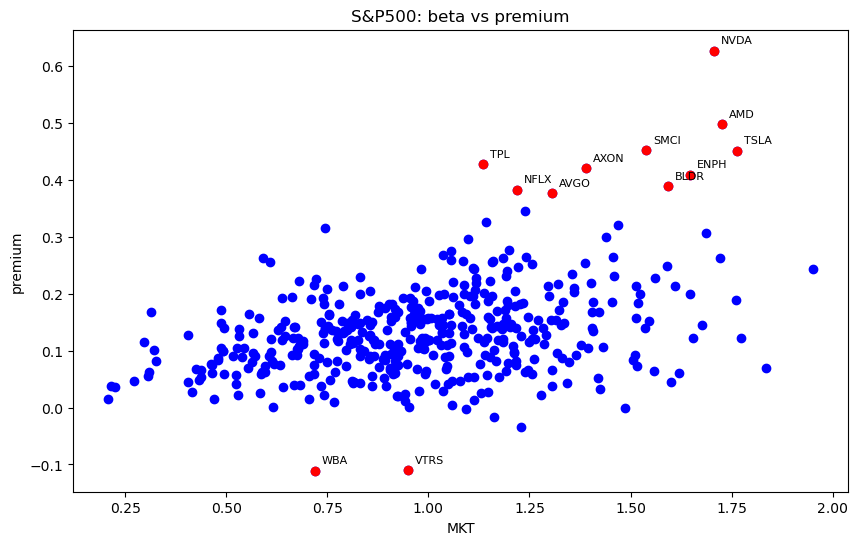

Create a scatter plot of the univariate (CAPM) MKT beta (x-axis) versus the sample mean excess return (y-axis).

1.3.#

For each pricing model, make a scatter plot the

x-axis: model risk premia

y-axis: sample risk premia

1.#

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

import statsmodels.api as sm

from statsmodels.regression.rolling import RollingOLS

from cmds.portfolio import performanceMetrics, tailMetrics, get_ols_metrics

from cmds.porttools import heatmap_vector, scatterplot_outliers_iqr

1.1.#

SAMPLING = 'weekly'

FILE_STOCKS = f'../data/spx_returns_{SAMPLING}.xlsx'

SHEET_STOCKS = 's&p500 rets'

FILE = f'../data/factor_pricing_data_{SAMPLING}.xlsx'

SHEET_FACS = 'factors (excess returns)'

if SAMPLING == 'monthly':

FREQ = 12

elif SAMPLING == 'weekly':

FREQ = 52

elif SAMPLING == 'daily':

FREQ = 252

stocks_raw = pd.read_excel(FILE_STOCKS, sheet_name=SHEET_STOCKS).set_index('date')

facs_sp500_raw = pd.read_excel(FILE,sheet_name=SHEET_FACS).set_index('Date')

# need risk-free rate to make stock returns into excess returns

rf_sp500_raw = pd.read_excel(FILE,sheet_name='risk-free rate').set_index('Date')

facs_sp500_raw = pd.concat([facs_sp500_raw, rf_sp500_raw],axis=1)

# align the dates

stocks, facs_sp500 = stocks_raw.align(facs_sp500_raw,axis=0,join='inner')

# excess returns

stocks = stocks.sub(facs_sp500['RF'],axis=0)

T,N = stocks.shape

K = facs_sp500.shape[1]

models = dict({

'CAPM': ['MKT'],

'Fama-French': ['MKT','SMB','HML'],

'4-Factor': ['MKT','HML','RMW','UMD']

})

errors = pd.DataFrame(index=['CAPM','Fama-French','4-Factor'],columns=['mean abs alpha'],dtype=float)

tab = dict()

for model in models:

tab[model] = get_ols_metrics(facs_sp500[models[model]],stocks,annualization=FREQ)

errors.loc[model,'mean abs alpha'] = tab[model]['alpha'].abs().mean()

display(errors.style.format('{:.2%}'))

| mean abs alpha | |

|---|---|

| CAPM | 5.83% |

| Fama-French | 5.62% |

| 4-Factor | 5.42% |

1.2.#

comp = pd.concat([stocks.mean()*FREQ,tab['CAPM']['MKT']],axis=1).rename(columns={0:'premium'})

ax = scatterplot_outliers_iqr(comp, col_x='MKT', col_y='premium', figsize=(10,6), title='S&P500: beta vs premium', k=2)