Long-Horizon Prediction with Persistent Signals#

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

SHEET_RETS = 'returns'

SHEET_METRICS = 'metrics'

rets = pd.read_excel("../data/crsp_market_data.xlsx", sheet_name=SHEET_RETS, index_col=0, parse_dates=True)

metrics = pd.read_excel("../data/crsp_market_data.xlsx", sheet_name=SHEET_METRICS, index_col=0, parse_dates=True)

HORZ = 5 # number of years; change this to desired horizon

FREQ = 12 # number of months per year

months = HORZ * FREQ

KEY_RETS = f'{HORZ}-year rets'

KEY_METRICS = 'dp annual'

data = pd.concat([rets['rets'], metrics['dp ratio']], axis=1)

data['dp annual'] = data['dp ratio'].rolling(window=FREQ).sum()

data['rets t+H'] = data['rets'].rolling(window=months).apply(lambda x: (x + 1).prod() - 1, raw=False)

#data['dp lag'] = data['dp smooth'].shift(months)

data[KEY_RETS] = data['rets t+H'].shift(-months)

import matplotlib.pyplot as plt

from matplotlib.ticker import FuncFormatter

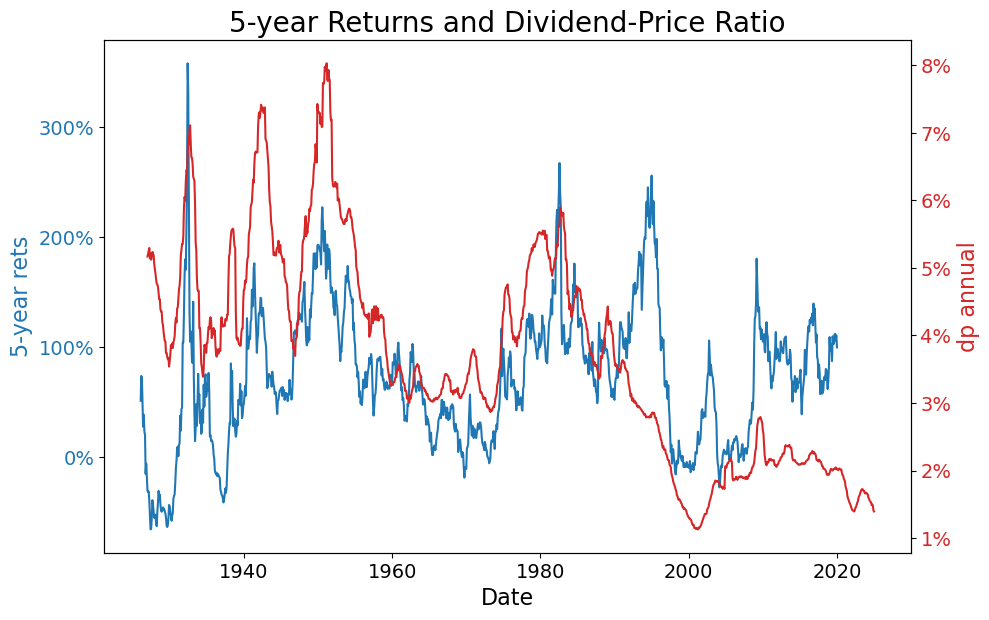

fig, ax1 = plt.subplots(figsize=(10, 6))

label_fontsize = 16

tick_fontsize = 14

title_fontsize = 20

percent_formatter = FuncFormatter(lambda x, pos: '{:.0f}%'.format(x * 100))

color1 = 'tab:blue'

ax1.set_xlabel('Date', fontsize=label_fontsize)

ax1.set_ylabel(KEY_RETS, color=color1, fontsize=label_fontsize)

ax1.plot(data.index, data[KEY_RETS], color=color1, label=KEY_RETS)

ax1.tick_params(axis='y', labelcolor=color1, labelsize=tick_fontsize)

ax1.tick_params(axis='x', labelsize=tick_fontsize)

ax1.yaxis.set_major_formatter(percent_formatter)

ax2 = ax1.twinx()

color2 = 'tab:red'

ax2.set_ylabel(KEY_METRICS, color=color2, fontsize=label_fontsize)

ax2.plot(data.index, data[KEY_METRICS], color=color2, label=KEY_METRICS)

ax2.tick_params(axis='y', labelcolor=color2, labelsize=tick_fontsize)

ax2.yaxis.set_major_formatter(percent_formatter)

fig.tight_layout()

plt.title(f'{HORZ}-year Returns and Dividend-Price Ratio', fontsize=title_fontsize)

plt.show()

corr_rets_dp = data[KEY_RETS].corr(data[KEY_METRICS])

print(f'Correlation: {corr_rets_dp:.0%}')

Correlation: 39%

import statsmodels.api as sm

import pandas as pd

from IPython.display import display

# Remove NaN values for regression

reg_data = data[[KEY_RETS, KEY_METRICS]].dropna()

# Prepare data for regression

Y = reg_data[KEY_RETS]

X = reg_data[KEY_METRICS]

# Add constant to X for intercept

X_with_const = sm.add_constant(X)

# Run OLS regression

model = sm.OLS(Y, X_with_const)

results = model.fit()

# Extract key statistics

alpha = results.params['const']

beta = results.params[KEY_METRICS]

r_squared = results.rsquared

t_stat_beta = results.tvalues[KEY_METRICS]

p_value_beta = results.pvalues[KEY_METRICS]

# Prepare main summary dataframe (alpha, beta, r-squared)

summary_df = pd.DataFrame([

[f"{alpha:.0%}", f"{beta:.1f}", f"{r_squared:.0%}"]

], columns=["alpha", "beta", "r-squared"], index=["OLS estimate"]).T

# Prepare t-stat and p-value dataframe for beta

beta_stats_df = pd.DataFrame(

[ [f"{t_stat_beta:.1f}"], [f"{p_value_beta:.0%}"] ],

columns=["beta"],

index=["t-stat", "p-value"]

)

display(summary_df)

display(beta_stats_df)

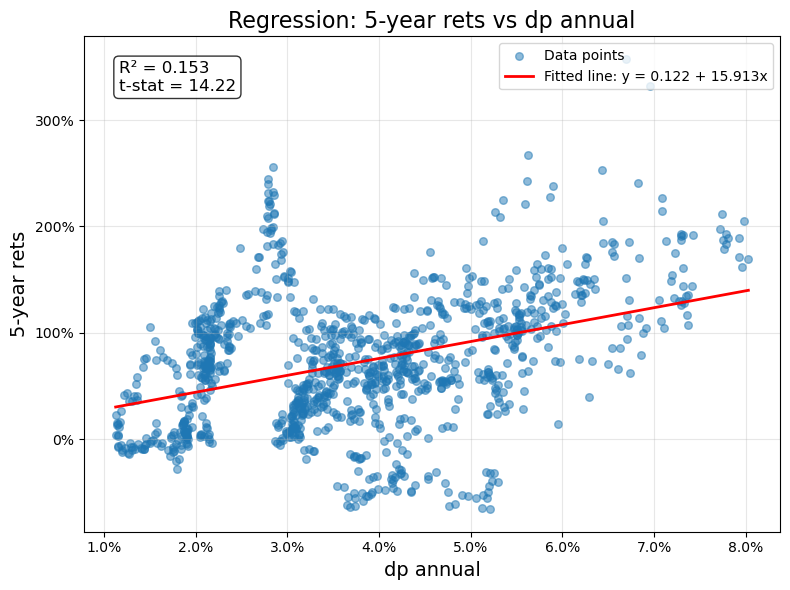

| OLS estimate | |

|---|---|

| alpha | 12% |

| beta | 15.9 |

| r-squared | 15% |

| beta | |

|---|---|

| t-stat | 14.2 |

| p-value | 0% |

# Create scatter plot with regression line

fig, ax = plt.subplots(figsize=(8, 6))

# Scatter plot

ax.scatter(X, Y, alpha=0.5, s=30, label='Data points')

# Add regression line

X_plot = np.linspace(X.min(), X.max(), 100)

Y_pred = alpha + beta * X_plot

ax.plot(X_plot, Y_pred, 'r-', linewidth=2, label=f'Fitted line: y = {alpha:.3f} + {beta:.3f}x')

# Format axes

ax.set_xlabel(KEY_METRICS, fontsize=14)

ax.set_ylabel(KEY_RETS, fontsize=14)

ax.set_title(f'Regression: {KEY_RETS} vs {KEY_METRICS}', fontsize=16)

# Add grid

ax.grid(True, alpha=0.3)

# Format y-axis as percentage

ax.yaxis.set_major_formatter(FuncFormatter(lambda x, pos: '{:.0f}%'.format(x * 100)))

ax.xaxis.set_major_formatter(FuncFormatter(lambda x, pos: '{:.1f}%'.format(x * 100)))

# Add legend with regression statistics

legend_text = f'R² = {r_squared:.3f}\nt-stat = {t_stat_beta:.2f}'

ax.text(0.05, 0.95, legend_text,

transform=ax.transAxes,

fontsize=12,

verticalalignment='top',

bbox=dict(boxstyle='round', facecolor='white', alpha=0.8))

ax.legend(loc='upper right')

plt.tight_layout()

plt.show()

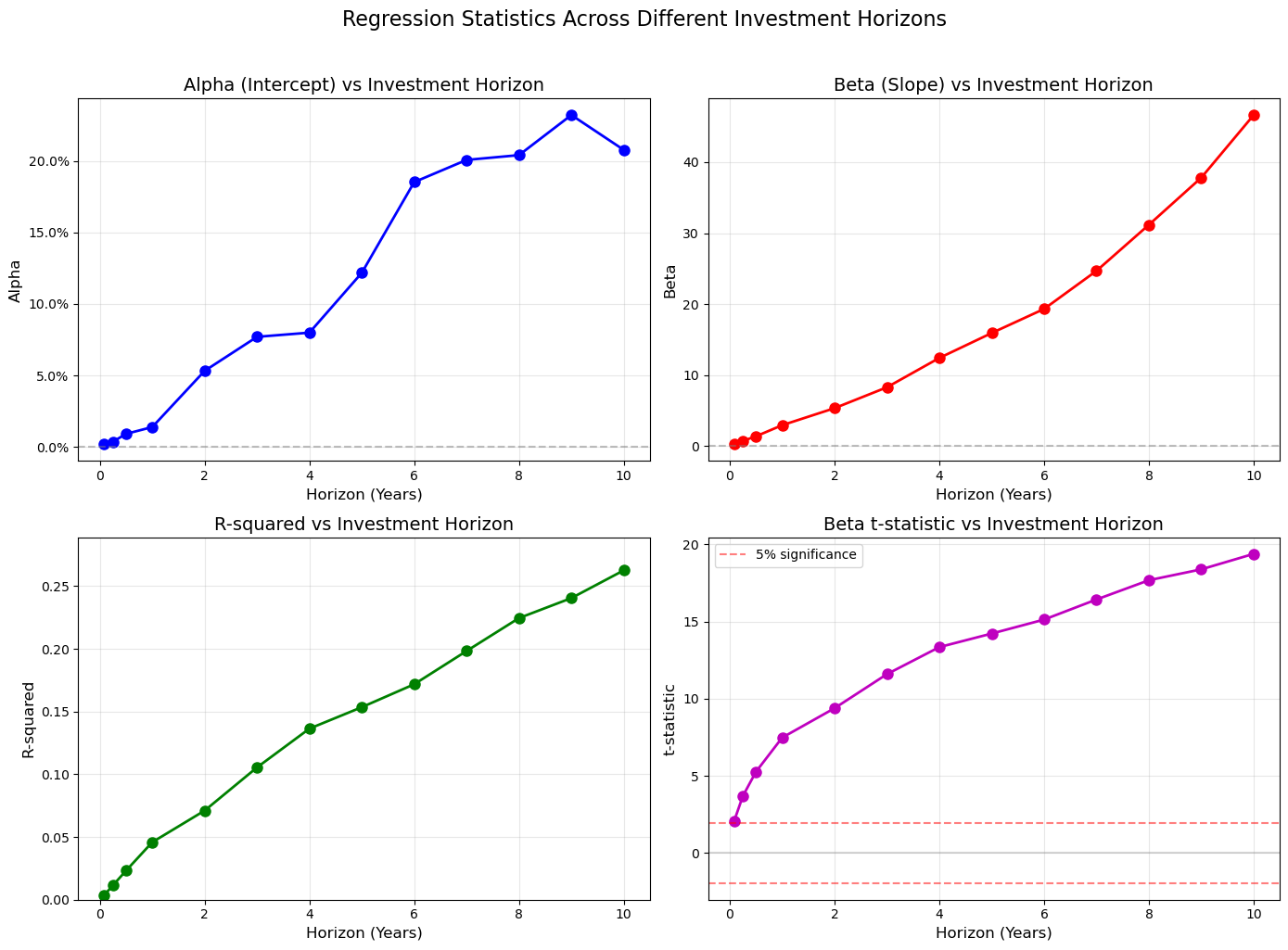

Various Horizons#

import statsmodels.api as sm

import warnings

warnings.filterwarnings('ignore')

# Define the horizons to analyze (in years)

horizons = [1/12,.25,.5, 1, 2, 3, 4, 5, 6, 7, 8, 9, 10]

# Initialize dictionaries to store results

results_estimates = {}

results_tstats = {}

results_pvalues = {}

# Loop over each horizon

for HORZ in horizons:

# Calculate the number of months

months = round(HORZ * FREQ)

# Prepare the data for this horizon

data_temp = pd.concat([rets['rets'], metrics['dp ratio']], axis=1)

data_temp['dp annual'] = data_temp['dp ratio'].rolling(window=FREQ).sum()

data_temp['rets t+H'] = data_temp['rets'].rolling(window=months).apply(lambda x: (x + 1).prod() - 1, raw=False)

data_temp[f'{HORZ}-year rets'] = data_temp['rets t+H'].shift(-months)

# Set up regression variables

key_rets_temp = f'{HORZ}-year rets'

key_metrics_temp = 'dp annual'

# Remove NaN values for regression

reg_data = data_temp[[key_rets_temp, key_metrics_temp]].dropna()

# Skip if not enough data

if len(reg_data) < 30: # Minimum observations for reasonable regression

continue

# Prepare data for regression

Y = reg_data[key_rets_temp]

X = reg_data[key_metrics_temp]

# Add constant to X for intercept

X_with_const = sm.add_constant(X)

# Run OLS regression

model = sm.OLS(Y, X_with_const)

results = model.fit()

# Store estimates

results_estimates[HORZ] = {

'Alpha': results.params['const'],

'Beta': results.params[key_metrics_temp],

'R-squared': results.rsquared,

'N': len(reg_data)

}

# Store t-statistics

results_tstats[HORZ] = {

'Alpha t-stat': results.tvalues['const'],

'Beta t-stat': results.tvalues[key_metrics_temp]

}

# Store p-values

results_pvalues[HORZ] = {

'Alpha p-value': results.pvalues['const'],

'Beta p-value': results.pvalues[key_metrics_temp]

}

print(f"Completed horizon: {HORZ} years (N={len(reg_data)} observations)")

print("\nAll horizons processed successfully!")

Completed horizon: 0.08333333333333333 years (N=1176 observations)

Completed horizon: 0.25 years (N=1174 observations)

Completed horizon: 0.5 years (N=1171 observations)

Completed horizon: 1 years (N=1165 observations)

Completed horizon: 2 years (N=1153 observations)

Completed horizon: 3 years (N=1141 observations)

Completed horizon: 4 years (N=1129 observations)

Completed horizon: 5 years (N=1117 observations)

Completed horizon: 6 years (N=1105 observations)

Completed horizon: 7 years (N=1093 observations)

Completed horizon: 8 years (N=1081 observations)

Completed horizon: 9 years (N=1069 observations)

Completed horizon: 10 years (N=1057 observations)

All horizons processed successfully!

from IPython.display import display, HTML

# Create DataFrame for estimates

df_estimates = pd.DataFrame(results_estimates).T

df_estimates.index.name = 'Horizon (Years)'

# Create DataFrame combining t-stats and p-values

df_tstats = pd.DataFrame(results_tstats).T

df_pvalues = pd.DataFrame(results_pvalues).T

# Combine t-stats and p-values into one dataframe

df_stats = pd.DataFrame(index=df_tstats.index)

df_stats.index.name = 'Horizon (Years)'

df_stats['Alpha t-stat'] = df_tstats['Alpha t-stat']

df_stats['Alpha p-value'] = df_pvalues['Alpha p-value']

df_stats['Beta t-stat'] = df_tstats['Beta t-stat']

df_stats['Beta p-value'] = df_pvalues['Beta p-value']

# # Display DataFrame 1: Estimates

# display(HTML("<h3>Regression Estimates Across Horizons</h3>"))

# display(df_estimates.round(4))

# display(HTML("<h3>T-Statistics and P-Values Across Horizons</h3>"))

# display(df_stats.round(4))

# Create a summary DataFrame (raw values, no formatting/scaling)

summary_df = pd.DataFrame()

summary_df['Alpha'] = df_estimates['Alpha']

summary_df['Beta'] = df_estimates['Beta']

summary_df['R²'] = df_estimates['R-squared']

summary_df['Beta t-stat'] = df_stats['Beta t-stat']

summary_df['Significant?'] = df_stats['Beta p-value'] < 0.05 # 5% significance level

summary_df['N obs'] = df_estimates['N'].astype(int)

# Set index to formatted string (1 decimal) for horizon

summary_df.index = summary_df.index.map(lambda x: f"{x:.1f}")

# Display the summary DataFrame with formatting using .style

display(HTML("<h3>Summary: Dividend-Price Ratio Predictive Power Across Horizons</h3>"))

display(

summary_df.style

.format({

'Alpha': '{:.1%}',

'Beta': '{:.1f}',

'R²': '{:.1%}',

'Beta t-stat': '{:.1f}',

'N obs': '{:d}'

})

.set_table_styles([{'selector': 'th', 'props': [('text-align', 'center')]}])

.set_properties(subset=['Alpha','Beta','R²','Beta t-stat', 'Significant?','N obs'], **{'text-align': 'center'})

)

Summary: Dividend-Price Ratio Predictive Power Across Horizons

| Alpha | Beta | R² | Beta t-stat | Significant? | N obs | |

|---|---|---|---|---|---|---|

| Horizon (Years) | ||||||

| 0.1 | 0.2% | 0.2 | 0.4% | 2.1 | True | 1176 |

| 0.2 | 0.4% | 0.7 | 1.2% | 3.7 | True | 1174 |

| 0.5 | 0.9% | 1.4 | 2.3% | 5.3 | True | 1171 |

| 1.0 | 1.4% | 2.9 | 4.6% | 7.5 | True | 1165 |

| 2.0 | 5.3% | 5.3 | 7.1% | 9.4 | True | 1153 |

| 3.0 | 7.7% | 8.3 | 10.5% | 11.6 | True | 1141 |

| 4.0 | 8.0% | 12.4 | 13.6% | 13.3 | True | 1129 |

| 5.0 | 12.2% | 15.9 | 15.3% | 14.2 | True | 1117 |

| 6.0 | 18.5% | 19.3 | 17.2% | 15.1 | True | 1105 |

| 7.0 | 20.1% | 24.7 | 19.8% | 16.4 | True | 1093 |

| 8.0 | 20.4% | 31.2 | 22.5% | 17.7 | True | 1081 |

| 9.0 | 23.2% | 37.8 | 24.0% | 18.4 | True | 1069 |

| 10.0 | 20.8% | 46.6 | 26.3% | 19.4 | True | 1057 |

# Create visualizations of how regression statistics change with horizon

fig, axes = plt.subplots(2, 2, figsize=(14, 10))

# Plot 1: Alpha across horizons

ax1 = axes[0, 0]

ax1.plot(df_estimates.index, df_estimates['Alpha'], 'bo-', linewidth=2, markersize=8)

ax1.axhline(y=0, color='gray', linestyle='--', alpha=0.5)

ax1.set_xlabel('Horizon (Years)', fontsize=12)

ax1.set_ylabel('Alpha', fontsize=12)

ax1.set_title('Alpha (Intercept) vs Investment Horizon', fontsize=14)

ax1.grid(True, alpha=0.3)

ax1.yaxis.set_major_formatter(FuncFormatter(lambda x, pos: '{:.1f}%'.format(x * 100)))

# Plot 2: Beta across horizons

ax2 = axes[0, 1]

ax2.plot(df_estimates.index, df_estimates['Beta'], 'ro-', linewidth=2, markersize=8)

ax2.axhline(y=0, color='gray', linestyle='--', alpha=0.5)

ax2.set_xlabel('Horizon (Years)', fontsize=12)

ax2.set_ylabel('Beta', fontsize=12)

ax2.set_title('Beta (Slope) vs Investment Horizon', fontsize=14)

ax2.grid(True, alpha=0.3)

# Plot 3: R-squared across horizons

ax3 = axes[1, 0]

ax3.plot(df_estimates.index, df_estimates['R-squared'], 'go-', linewidth=2, markersize=8)

ax3.set_xlabel('Horizon (Years)', fontsize=12)

ax3.set_ylabel('R-squared', fontsize=12)

ax3.set_title('R-squared vs Investment Horizon', fontsize=14)

ax3.grid(True, alpha=0.3)

ax3.set_ylim([0, max(df_estimates['R-squared']) * 1.1])

# Plot 4: Beta t-statistics across horizons

ax4 = axes[1, 1]

ax4.plot(df_stats.index, df_stats['Beta t-stat'], 'mo-', linewidth=2, markersize=8)

ax4.axhline(y=1.96, color='red', linestyle='--', alpha=0.5, label='5% significance')

ax4.axhline(y=-1.96, color='red', linestyle='--', alpha=0.5)

ax4.axhline(y=0, color='gray', linestyle='-', alpha=0.3)

ax4.set_xlabel('Horizon (Years)', fontsize=12)

ax4.set_ylabel('t-statistic', fontsize=12)

ax4.set_title('Beta t-statistic vs Investment Horizon', fontsize=14)

ax4.grid(True, alpha=0.3)

ax4.legend()

plt.suptitle('Regression Statistics Across Different Investment Horizons', fontsize=16, y=1.02)

plt.tight_layout()

plt.show()

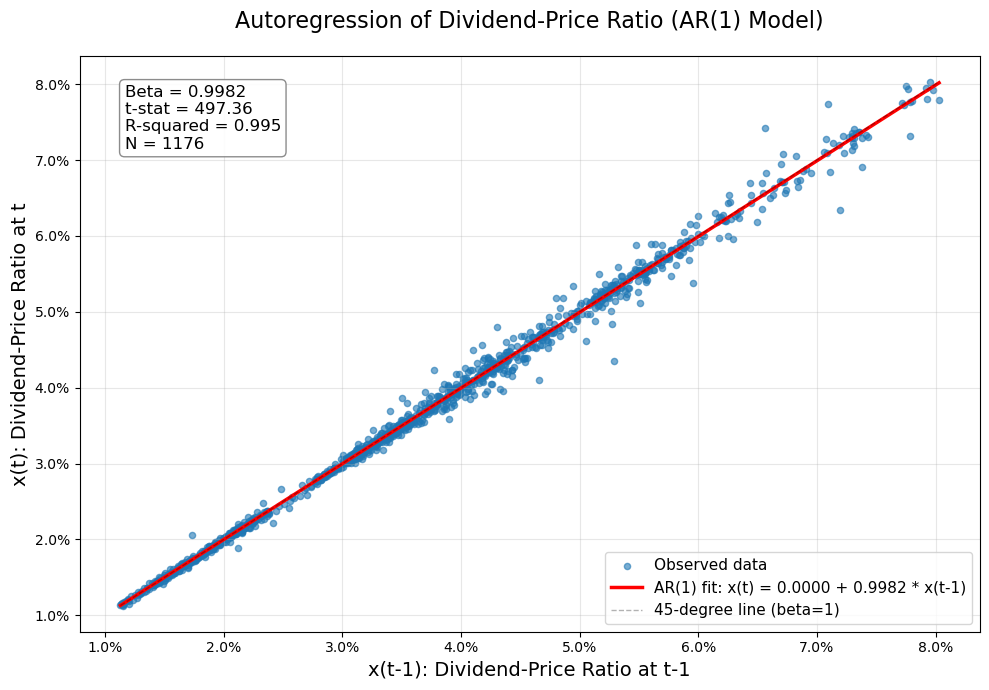

Autoregression of the Dividend-Price Ratio#

Now we examine the persistence of the dividend-price ratio by running an autoregression (AR(1) model):

x(t) = alpha + beta × x(t-1) + error(t)

where x(t) is the dividend-price ratio at time t.

import statsmodels.api as sm

import pandas as pd

from IPython.display import display

# Prepare data for autoregression

ar_data = data[['dp annual']].dropna().copy()

# Create lagged variable (one-step ahead)

ar_data['dp annual lagged'] = ar_data['dp annual'].shift(1)

# Remove rows with NaN (from lagging)

ar_data = ar_data.dropna()

# Set up regression: x(t) = alpha + beta * x(t-1) + epsilon

Y = ar_data['dp annual']

X = ar_data['dp annual lagged']

# Add constant for intercept

X_with_const = sm.add_constant(X)

# Run OLS regression

ar_model = sm.OLS(Y, X_with_const)

ar_results = ar_model.fit()

# Extract key statistics

ar_alpha = ar_results.params['const']

ar_beta = ar_results.params['dp annual lagged']

ar_r_squared = ar_results.rsquared

ar_t_stat_alpha = ar_results.tvalues['const']

ar_t_stat_beta = ar_results.tvalues['dp annual lagged']

ar_p_value_alpha = ar_results.pvalues['const']

ar_p_value_beta = ar_results.pvalues['dp annual lagged']

# Create main results dataframe

ar_main_results = pd.DataFrame([

[f"{ar_alpha:.6f}", f"{ar_beta:.6f}", f"{ar_r_squared:.4f}", len(ar_data)]

], columns=["Alpha", "Beta", "R-squared", "N"], index=["AR(1) Estimates"])

# Create t-statistics and p-values dataframe

ar_stats_results = pd.DataFrame([

[f"{ar_t_stat_alpha:.3f}", f"{ar_t_stat_beta:.3f}"],

[f"{ar_p_value_alpha:.4f}", f"{ar_p_value_beta:.4f}"]

], columns=["Alpha", "Beta"], index=["t-statistic", "p-value"])

# Display results

display(ar_main_results)

display(ar_stats_results)

| Alpha | Beta | R-squared | N | |

|---|---|---|---|---|

| AR(1) Estimates | 0.000035 | 0.998179 | 0.9953 | 1176 |

| Alpha | Beta | |

|---|---|---|

| t-statistic | 0.437 | 497.362 |

| p-value | 0.6623 | 0.0000 |

# Visualization of the autoregression

fig, ax = plt.subplots(figsize=(10, 7))

# Scatter plot

ax.scatter(X, Y, alpha=0.6, s=20, label='Observed data')

# Add regression line

X_plot = np.linspace(X.min(), X.max(), 100)

Y_pred = ar_alpha + ar_beta * X_plot

ax.plot(X_plot, Y_pred, 'r-', linewidth=2.5, label=f'AR(1) fit: x(t) = {ar_alpha:.4f} + {ar_beta:.4f} * x(t-1)')

# Add 45-degree line for reference (perfect persistence would be beta=1)

min_val = min(X.min(), Y.min())

max_val = max(X.max(), Y.max())

ax.plot([min_val, max_val], [min_val, max_val], 'k--', alpha=0.3, linewidth=1, label='45-degree line (beta=1)')

# Format axes

ax.set_xlabel('x(t-1): Dividend-Price Ratio at t-1', fontsize=14)

ax.set_ylabel('x(t): Dividend-Price Ratio at t', fontsize=14)

ax.set_title('Autoregression of Dividend-Price Ratio (AR(1) Model)', fontsize=16, pad=20)

# Format axes as percentage

ax.yaxis.set_major_formatter(FuncFormatter(lambda x, pos: '{:.1f}%'.format(x * 100)))

ax.xaxis.set_major_formatter(FuncFormatter(lambda x, pos: '{:.1f}%'.format(x * 100)))

# Add grid

ax.grid(True, alpha=0.3)

# Add statistics box

stats_text = f'Beta = {ar_beta:.4f}\nt-stat = {ar_t_stat_beta:.2f}\nR-squared = {ar_r_squared:.3f}\nN = {len(ar_data)}'

ax.text(0.05, 0.95, stats_text,

transform=ax.transAxes,

fontsize=12,

verticalalignment='top',

bbox=dict(boxstyle='round', facecolor='white', edgecolor='gray', alpha=0.9))

ax.legend(loc='lower right', fontsize=11)

plt.tight_layout()

plt.show()