Solution - Replicating Regressions#

Data#

Use the file,

data/port_decomp_example.xlsx.

The data file contains…

Return rates, \(r_t^i\), for various asset classes, (via ETFs.)

Most notable among these securities is

SPY, the return on the S&P 500. Denote this as \(r^{\spy}_t\).A separate tab gives return rates for a particular portfolio, \(r_t^p\).

1. Decomposition#

1. Single Factor Exposure#

Estimate the regression of the portfolio return on SPY:

Specifically, report your estimates of alpha, beta, and the r-squared.

2. Multi-factor Exposure#

Estimate the regression of the portfolio return on SPY and on HYG, the return on high-yield

corporate bonds, denoted as \(r^{\hyg}_t\):

Specifically, report your estimates of alpha, the betas, and the r-squared.

*Note that the parameters (such as \(\beta^{\spy}\)) in this multivariate model are not the same as used in the univariate model of part 1.

3. Replication Values#

Calculate the series of fitted regression values, sometimes referred to as \(\hat{y}\) in standard textbooks:

Your statistical package will output these fitted values for you, or you can construct them using the estimated parameters.

How does this compare to the r-squared of the regression in problem 2?

4. Uni vs Multi#

How do the SPY betas differ across the univariate and multivariate models? How does this relate to the

correlation between \(r^{\spy}\) and \(r^{\hyg}\)?

Solution 1#

import pandas as pd

import numpy as np

import statsmodels.api as sm

from sklearn.linear_model import LinearRegression

from matplotlib import pyplot as plt

INFILE = "../data/assignment_2_data.xlsx"

info = pd.read_excel(INFILE,sheet_name='descriptions').set_index('ticker')

info

| shortName | quoteType | currency | volume | totalAssets | longBusinessSummary | |

|---|---|---|---|---|---|---|

| ticker | ||||||

| SPY | SPDR S&P 500 | ETF | USD | 25604208 | 627773800448 | The Trust seeks to achieve its investment obje... |

| EFA | iShares MSCI EAFE ETF | ETF | USD | 10653257 | 54985711616 | The fund generally will invest at least 80% of... |

| EEM | iShares MSCI Emerging Index Fun | ETF | USD | 17962107 | 17468592128 | The fund generally will invest at least 80% of... |

| PSP | Invesco Global Listed Private E | ETF | USD | 8928 | 277930496 | The fund generally will invest at least 90% of... |

| QAI | NYLI Hedge Multi-Strategy Track | ETF | USD | 49257 | 637390272 | The fund is a "fund of funds" which means it i... |

| HYG | iShares iBoxx $ High Yield Corp | ETF | USD | 22374708 | 15881510912 | The underlying index is a rules-based index co... |

| DBC | Invesco DB Commodity Index Trac | ETF | USD | 478168 | 1387142912 | The fund pursues its investment objective by i... |

| IYR | iShares U.S. Real Estate ETF | ETF | USD | 2699001 | 4990495744 | The fund seeks to track the investment results... |

| IEF | iShares 7-10 Year Treasury Bond | ETF | USD | 2340833 | 32854654976 | The underlying index measures the performance ... |

| BWX | SPDR Bloomberg International Tr | ETF | USD | 180426 | 959621824 | The fund generally invests substantially all, ... |

| TIP | iShares TIPS Bond ETF | ETF | USD | 2132017 | 15497157632 | The index tracks the performance of inflation-... |

| SHV | iShares Short Treasury Bond ETF | ETF | USD | 1850899 | 18620065792 | The fund will invest at least 80% of its asset... |

rets = pd.read_excel(INFILE,sheet_name='total returns').set_index('Date')

rets

| BWX | DBC | EEM | EFA | HYG | IEF | IYR | PSP | QAI | SHV | SPY | TIP | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||||

| 2015-02-28 | -0.010834 | 0.044253 | 0.044080 | 0.063378 | 0.022312 | -0.024717 | -0.025976 | 0.064102 | 0.034138 | 0.000181 | 0.056204 | -0.012886 |

| 2015-03-31 | -0.013922 | -0.060539 | -0.014973 | -0.014286 | -0.009478 | 0.008561 | 0.010745 | -0.010454 | -0.001667 | -0.000091 | -0.015706 | -0.004819 |

| 2015-04-30 | 0.019579 | 0.071471 | 0.068527 | 0.036466 | 0.008714 | -0.006330 | -0.048160 | 0.053982 | 0.002004 | 0.000091 | 0.009834 | 0.006779 |

| 2015-05-31 | -0.032312 | -0.031711 | -0.041045 | 0.001955 | 0.003555 | -0.004164 | -0.003311 | 0.026868 | -0.000333 | 0.000000 | 0.012856 | -0.010056 |

| 2015-06-30 | -0.007442 | 0.016375 | -0.029309 | -0.031182 | -0.018871 | -0.016309 | -0.043979 | -0.019153 | -0.013671 | 0.000091 | -0.020312 | -0.010246 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2024-08-31 | 0.030519 | -0.020815 | 0.009779 | 0.032603 | 0.015474 | 0.013458 | 0.054008 | 0.001225 | 0.007648 | 0.004979 | 0.023366 | 0.007990 |

| 2024-09-30 | 0.023484 | 0.007237 | 0.057413 | 0.007833 | 0.016971 | 0.013825 | 0.030631 | 0.051617 | 0.014548 | 0.004586 | 0.021005 | 0.014976 |

| 2024-10-31 | -0.048497 | 0.014369 | -0.030746 | -0.052732 | -0.009636 | -0.033874 | -0.034947 | -0.013779 | -0.005923 | 0.003576 | -0.008924 | -0.018469 |

| 2024-11-30 | 0.002212 | -0.019920 | -0.026772 | -0.003156 | 0.016446 | 0.010209 | 0.040688 | 0.064952 | 0.022891 | 0.003697 | 0.059633 | 0.004981 |

| 2024-12-31 | -0.032164 | 0.011994 | -0.013676 | -0.029502 | -0.012152 | -0.023790 | -0.090579 | -0.053956 | -0.016640 | 0.000161 | -0.020497 | -0.017664 |

119 rows × 12 columns

port = pd.read_excel(INFILE,sheet_name='portfolio returns').set_index('Date')

port

| portfolio | |

|---|---|

| Date | |

| 2015-02-28 | 0.011887 |

| 2015-03-31 | 0.001796 |

| 2015-04-30 | 0.000374 |

| 2015-05-31 | 0.004765 |

| 2015-06-30 | -0.023278 |

| ... | ... |

| 2024-08-31 | 0.019085 |

| 2024-09-30 | 0.027655 |

| 2024-10-31 | -0.022130 |

| 2024-11-30 | 0.034685 |

| 2024-12-31 | -0.046241 |

119 rows × 1 columns

1.1#

X = sm.add_constant(rets['SPY'])

y = port

mod = sm.OLS(y, X).fit()

mod.summary()

| Dep. Variable: | portfolio | R-squared: | 0.780 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | 0.778 |

| Method: | Least Squares | F-statistic: | 414.7 |

| Date: | Tue, 07 Jan 2025 | Prob (F-statistic): | 2.86e-40 |

| Time: | 16:34:05 | Log-Likelihood: | 329.70 |

| No. Observations: | 119 | AIC: | -655.4 |

| Df Residuals: | 117 | BIC: | -649.8 |

| Df Model: | 1 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | -0.0034 | 0.001 | -2.332 | 0.021 | -0.006 | -0.001 |

| SPY | 0.6474 | 0.032 | 20.365 | 0.000 | 0.584 | 0.710 |

| Omnibus: | 3.740 | Durbin-Watson: | 1.968 |

|---|---|---|---|

| Prob(Omnibus): | 0.154 | Jarque-Bera (JB): | 3.181 |

| Skew: | 0.314 | Prob(JB): | 0.204 |

| Kurtosis: | 3.497 | Cond. No. | 22.7 |

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

1.2#

X = sm.add_constant(rets[['SPY', 'HYG']])

y = port

mod_multi = sm.OLS(y, X).fit()

mod_multi.summary()

| Dep. Variable: | portfolio | R-squared: | 0.825 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | 0.822 |

| Method: | Least Squares | F-statistic: | 274.1 |

| Date: | Tue, 07 Jan 2025 | Prob (F-statistic): | 1.10e-44 |

| Time: | 16:34:05 | Log-Likelihood: | 343.45 |

| No. Observations: | 119 | AIC: | -680.9 |

| Df Residuals: | 116 | BIC: | -672.6 |

| Df Model: | 2 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | -0.0027 | 0.001 | -2.051 | 0.043 | -0.005 | -9.11e-05 |

| SPY | 0.4241 | 0.050 | 8.549 | 0.000 | 0.326 | 0.522 |

| HYG | 0.5404 | 0.098 | 5.492 | 0.000 | 0.346 | 0.735 |

| Omnibus: | 0.907 | Durbin-Watson: | 2.253 |

|---|---|---|---|

| Prob(Omnibus): | 0.635 | Jarque-Bera (JB): | 0.879 |

| Skew: | 0.204 | Prob(JB): | 0.644 |

| Kurtosis: | 2.898 | Cond. No. | 85.4 |

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

Notice that the beta on SPY is much lower now that we include HYG. Also note that the R-squared is a little higher.

1.3.#

The squared correlation is exactly the R^2, as R^2 captures the correlation of Portfolio’s return and the combined space spanned by both regressors.

corr_port = port.corrwith(mod.fittedvalues).iloc[0]

corr_port_multi = port.corrwith(mod_multi.fittedvalues).iloc[0]

print(f'Correlation between portfolio and replication: {corr_port_multi:.2%}.')

print(f'Square of this correaltion is {corr_port_multi**2:.2%}\nwhich equals the R-squared.')

Correlation between portfolio and replication: 90.85%.

Square of this correaltion is 82.54%

which equals the R-squared.

1.4.#

TICKreg1 = 'SPY'

TICKreg2 = 'HYG'

corrREGS = rets[TICKreg2].corr(rets[TICKreg1])

print(f'Correlation between {TICKreg1} and {TICKreg2} is {corrREGS:.1%}')

Correlation between SPY and HYG is 81.9%

The beta for SPY in (2) is much smaller than in (1). This is because HYG and SPY are significantly correlated, therefore a large proportion of the variation in the Portfolio return which was being attributed to SPY (in eq 1) was actually better explained by HYG. Thus, in eq (2) this gets attributed more directly to HYG, and less is attributed to SPY.

2. Portfolio Decomposition#

1. Decompose portfolio holdings#

The portfolio return, \(r_t^p\), is a combination of the base assets that are provided here. Use linear regression to uncover which weights were used in constructing the portfolio.

where \(\boldsymbol{r}\) denotes the vector of returns for the individual securities.

What does the regression find were the original weights?

How precise is the estimation? Consider the R-squared and t-stats.

Feel free to include an \(\alpha\) in this model, even though you know the portfolio is an exact function of the individual securities. The estimation should find \(\alpha\) of (nearly) zero.

2. Replicate an asset#

Suppose that we want to mimic a return, EEM using the other returns. Run the following regression–but

do so only using data through the end of 2022.

where \(\boldsymbol{r}\) denotes the vector of returns for the other securities, excluding the target, EEM.

(a)#

Report the r-squared and the estimate of the vector, \(\boldsymbol{\beta}\).

(b)#

Report the t-stats of the explanatory returns. Which have absolute value greater than 2?

(c)#

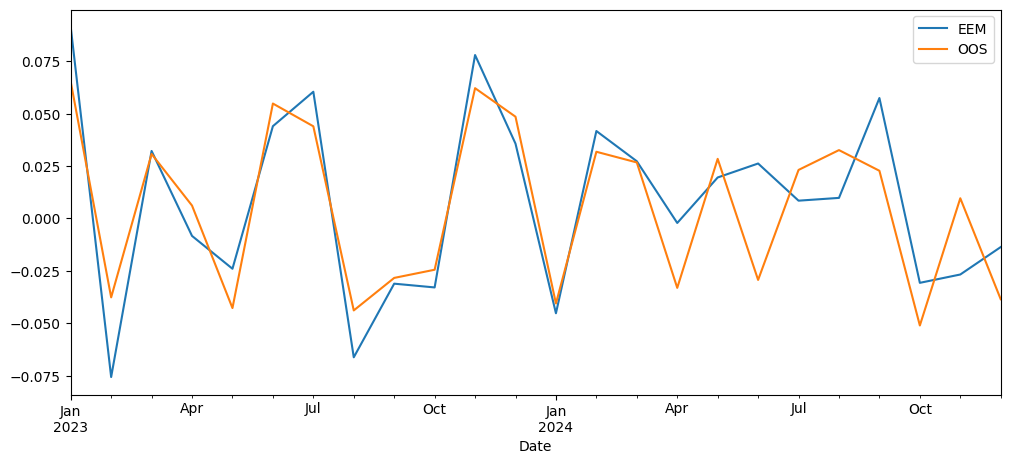

Plot the returns of EEM along with the replication values.

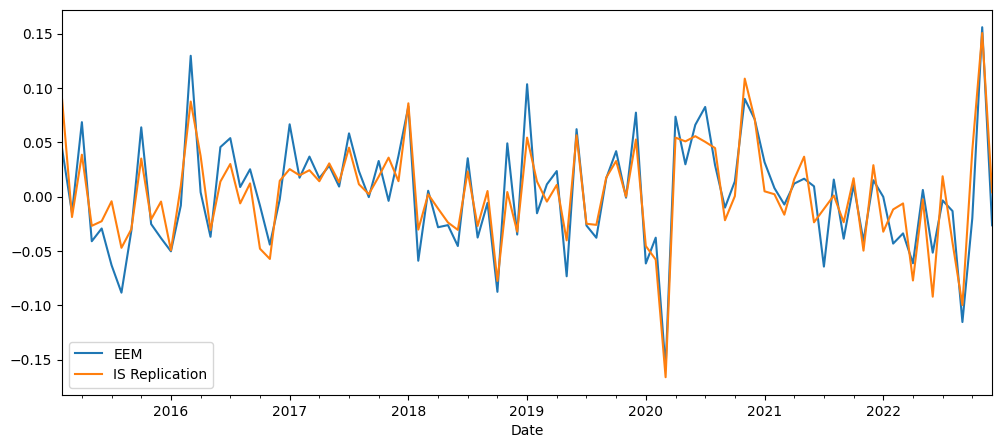

3. Out-of-Sample Fit#

Perhaps the replication results in the previous problem are overstated given that they estimated the parameters within a sample and then evaluated how well the result fit in the same sample. This is known as in-sample fit.

Using the estimates through 2022, (the α and βˆ from the previous problem,) calculate the out-of-sample (OOS) values of the replication, using the 2023-2024 returns, denoted \(\boldsymbol{r}_t^{\text{oos}}\):

(a)#

What is the correlation between \(\hat{r}_t^{\targ}\) and \(\boldsymbol{r}_t^{\text{oos}}\)?

(b)#

How does this compare to the r-squared from the regression above based on in-sample data, (through 2022?)

Solution 2#

2.1#

X = sm.add_constant(rets)

y = port

mod_exact = sm.OLS(y, X).fit()

display(mod_exact.params.to_frame().rename(columns={0:'weights'}).sort_values('weights',ascending=False).T.style.format('{:.2f}'))

mod_exact.summary()

| IYR | PSP | QAI | IEF | SHV | EEM | EFA | HYG | const | BWX | DBC | SPY | TIP | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| weights | 0.25 | 0.25 | 0.25 | 0.25 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -0.00 |

| Dep. Variable: | portfolio | R-squared: | 1.000 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | 1.000 |

| Method: | Least Squares | F-statistic: | 1.685e+29 |

| Date: | Tue, 07 Jan 2025 | Prob (F-statistic): | 0.00 |

| Time: | 16:34:05 | Log-Likelihood: | 4114.2 |

| No. Observations: | 119 | AIC: | -8202. |

| Df Residuals: | 106 | BIC: | -8166. |

| Df Model: | 12 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 1.735e-16 | 3.3e-17 | 5.259 | 0.000 | 1.08e-16 | 2.39e-16 |

| BWX | 1.665e-16 | 2.13e-15 | 0.078 | 0.938 | -4.05e-15 | 4.39e-15 |

| DBC | 6.939e-18 | 6.74e-16 | 0.010 | 0.992 | -1.33e-15 | 1.34e-15 |

| EEM | 7.008e-16 | 9.75e-16 | 0.719 | 0.474 | -1.23e-15 | 2.63e-15 |

| EFA | 3.634e-16 | 1.57e-15 | 0.232 | 0.817 | -2.74e-15 | 3.47e-15 |

| HYG | 2.776e-16 | 2.28e-15 | 0.122 | 0.903 | -4.25e-15 | 4.8e-15 |

| IEF | 0.2500 | 3e-15 | 8.34e+13 | 0.000 | 0.250 | 0.250 |

| IYR | 0.2500 | 8.33e-16 | 3e+14 | 0.000 | 0.250 | 0.250 |

| PSP | 0.2500 | 1.08e-15 | 2.31e+14 | 0.000 | 0.250 | 0.250 |

| QAI | 0.2500 | 5.36e-15 | 4.66e+13 | 0.000 | 0.250 | 0.250 |

| SHV | 1.11e-15 | 1.58e-14 | 0.070 | 0.944 | -3.02e-14 | 3.24e-14 |

| SPY | 0 | 1.56e-15 | 0 | 1.000 | -3.1e-15 | 3.1e-15 |

| TIP | -1.665e-16 | 3.8e-15 | -0.044 | 0.965 | -7.69e-15 | 7.36e-15 |

| Omnibus: | 17.654 | Durbin-Watson: | 0.719 |

|---|---|---|---|

| Prob(Omnibus): | 0.000 | Jarque-Bera (JB): | 38.094 |

| Skew: | 0.563 | Prob(JB): | 5.35e-09 |

| Kurtosis: | 5.533 | Cond. No. | 702. |

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

2.2#

T1 = '2022'

T2 = '2023'

TICKrep = 'EEM'

rets_IS = rets.loc[:T1,:]

X = sm.add_constant(rets_IS.drop(columns=TICKrep))

y = rets_IS[[TICKrep]]

mod_replicate = sm.OLS(y, X).fit()

mod_replicate.summary()

| Dep. Variable: | EEM | R-squared: | 0.789 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | 0.761 |

| Method: | Least Squares | F-statistic: | 28.25 |

| Date: | Tue, 07 Jan 2025 | Prob (F-statistic): | 1.50e-23 |

| Time: | 16:34:05 | Log-Likelihood: | 221.60 |

| No. Observations: | 95 | AIC: | -419.2 |

| Df Residuals: | 83 | BIC: | -388.6 |

| Df Model: | 11 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 0.0045 | 0.004 | 1.231 | 0.222 | -0.003 | 0.012 |

| BWX | 0.8016 | 0.218 | 3.682 | 0.000 | 0.369 | 1.235 |

| DBC | -0.0003 | 0.073 | -0.004 | 0.997 | -0.145 | 0.144 |

| EFA | 0.5235 | 0.184 | 2.844 | 0.006 | 0.157 | 0.890 |

| HYG | -0.2021 | 0.237 | -0.853 | 0.396 | -0.673 | 0.269 |

| IEF | -0.8203 | 0.350 | -2.343 | 0.022 | -1.517 | -0.124 |

| IYR | -0.0130 | 0.094 | -0.139 | 0.890 | -0.200 | 0.173 |

| PSP | -0.1470 | 0.142 | -1.038 | 0.302 | -0.429 | 0.135 |

| QAI | 1.9912 | 0.560 | 3.558 | 0.001 | 0.878 | 3.104 |

| SHV | -2.1211 | 3.064 | -0.692 | 0.491 | -8.215 | 3.973 |

| SPY | -0.2012 | 0.183 | -1.098 | 0.275 | -0.566 | 0.163 |

| TIP | 0.2022 | 0.431 | 0.469 | 0.640 | -0.656 | 1.060 |

| Omnibus: | 1.305 | Durbin-Watson: | 2.314 |

|---|---|---|---|

| Prob(Omnibus): | 0.521 | Jarque-Bera (JB): | 1.215 |

| Skew: | -0.272 | Prob(JB): | 0.545 |

| Kurtosis: | 2.895 | Cond. No. | 1.19e+03 |

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 1.19e+03. This might indicate that there are

strong multicollinearity or other numerical problems.

The R-squared is reported in the table above.#

Note that while we can estimate an R-squared, it doesn’t make much sense in a regression without an intercept.

It does not need to be between 0 and 1.

The stats-models Python package puts a “Note” at the bottom of the table above reminding users of that fact.

See the t-stats below, in descending order:#

mod_replicate.tvalues.sort_values(ascending=False).to_frame().rename(columns={0:'t-stats'}).T.style.format('{:.1f}')

| BWX | QAI | EFA | const | TIP | DBC | IYR | SHV | HYG | PSP | SPY | IEF | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| t-stats | 3.7 | 3.6 | 2.8 | 1.2 | 0.5 | -0.0 | -0.1 | -0.7 | -0.9 | -1.0 | -1.1 | -2.3 |

pd.concat([y, mod_replicate.fittedvalues.rename('IS Replication')], axis=1).plot(figsize=(12, 5))

plt.show()

2.3#

reg = LinearRegression(fit_intercept=True).fit(X,y)

fit_comp_IS = pd.concat([y,pd.DataFrame(reg.predict(X),index=y.index)],axis=1).rename(columns={0:'IS'})

corr_IS = fit_comp_IS.corr().iloc[0,1]

rets_OOS = rets.loc[T2:,:]

X = sm.add_constant(rets_OOS.drop(columns=TICKrep))

y = rets_OOS[[TICKrep]]

fit_comp_OOS = pd.concat([y,pd.DataFrame(reg.predict(X),index=y.index)],axis=1).rename(columns={0:'OOS'})

corr_OOS = fit_comp_OOS.corr().iloc[0,1]

print(f'Correlation between {TICKrep} and Replicating Portfolio')

print(f'In-Sample: {corr_IS:.1%}')

print(f'Out-of-Sample: {corr_OOS:.1%}')

Correlation between EEM and Replicating Portfolio

In-Sample: 88.8%

Out-of-Sample: 85.0%

fit_comp_OOS.plot(figsize=(12, 5))

plt.show()